Haynesville Shale

Haynesville Shale Play Examples

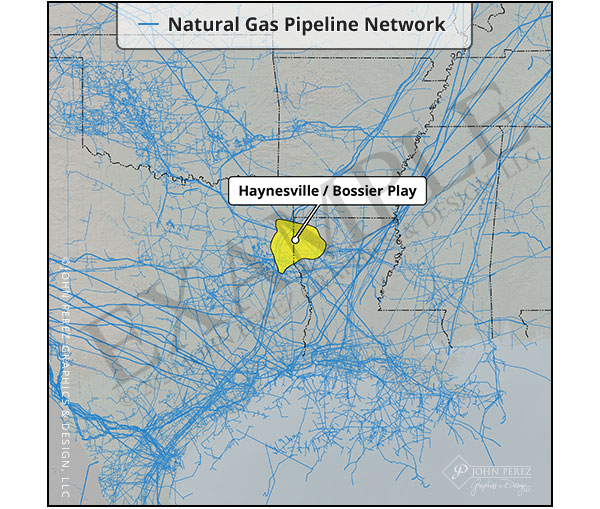

EAST TEXAS & WESTERN LOUISIANA HAYNESVILLE – BOSSIER PLAY

Haynesville News

The U.S. Could See Record Natural Gas Production In 2022

Haynesville Shale

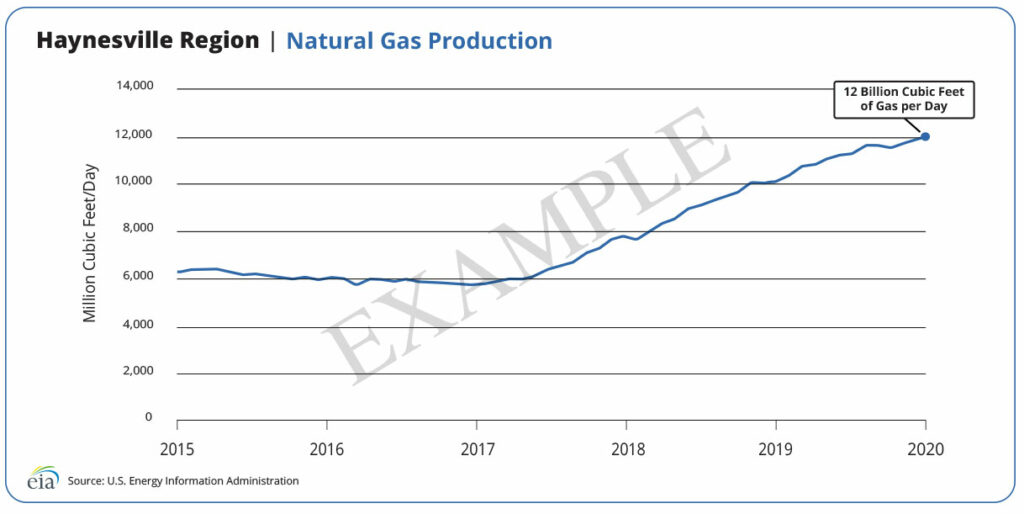

The Haynesville is set to become the largest source of gas output growth in the US, forecast to add about 10 Bcfd from 2020 to 2035, growing by 86% during that timeframe. The region is forecast to account for about 21% of the country’s gas production in 2035, compared to 13% in 2020.

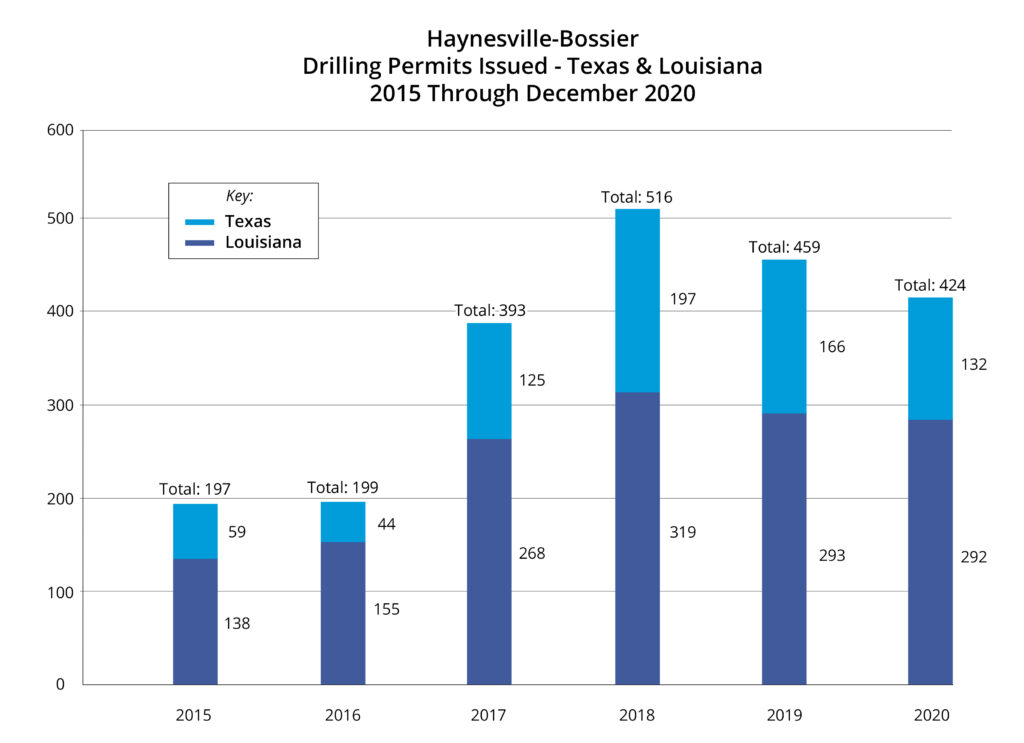

It remains poised to see a production growth of 5 Bcfd or more over the next five years based on a conservative level of drilling on the back of robust permitting activity, an expanding inventory of commercial locations that includes East Texas and the mid-Bossier and improving 2-month initial production results, Rystad Energy estimates.

A key factor in Haynesville’s ability to sustain an advantage against the Appalachian region will be to maintain the relative ease with which operators can transport gas from wellheads to Gulf coast markets, compared to the bottlenecks and mid-stream project cancellations that producers in the Northeast have to grapple with.

Our analysis on Haynesville’s current and planned takeaway capacity concludes that the basin has the capacity to sustain the forecast production growth up to 2024, the year when potential bottlenecks could start, unless new pipeline projects get approved.

As Haynesville’s second growth phase began and operators returned to the previous record production numbers from the first boom in late-2019, the system touched the key 90% level of utilization, above which it may come under strain with bottlenecks occurring. The LEAP, Index 99, and the CJ Express pipelines have since alleviated these potential strains, with utilization rates currently back near 70%.

Our analysis visualizes several different scenarios that the system may face over the coming years. Under a scenario in which all new projects are approved, constructed, and are brought online, and the Mid-Con stays at its currently forecast low levels, the system will stay at a level comfortably under 90% well into the medium term, providing sufficient capacity for a booming third growth phase.

Sources:

Rystad Energy – Apr 25, 2021, 6:00 PM CDT

There are several reasons why the Haynesville Shale stands apart:

- USGS 2016 estimates undiscovered, technically recoverable mean resources of 1.1 Billion Barrels of Oil & 195.8 Trillion Cubic Feet of Gas in the Upper Jurassic Haynesville Formation.

- Naturally high-pressured reservoir raises gas to the surface, reducing initial artificial lift and associated costs.

- Favorable geologic composition for Hydraulic fracturing, recompletions and refracs of existing horizontal wells.

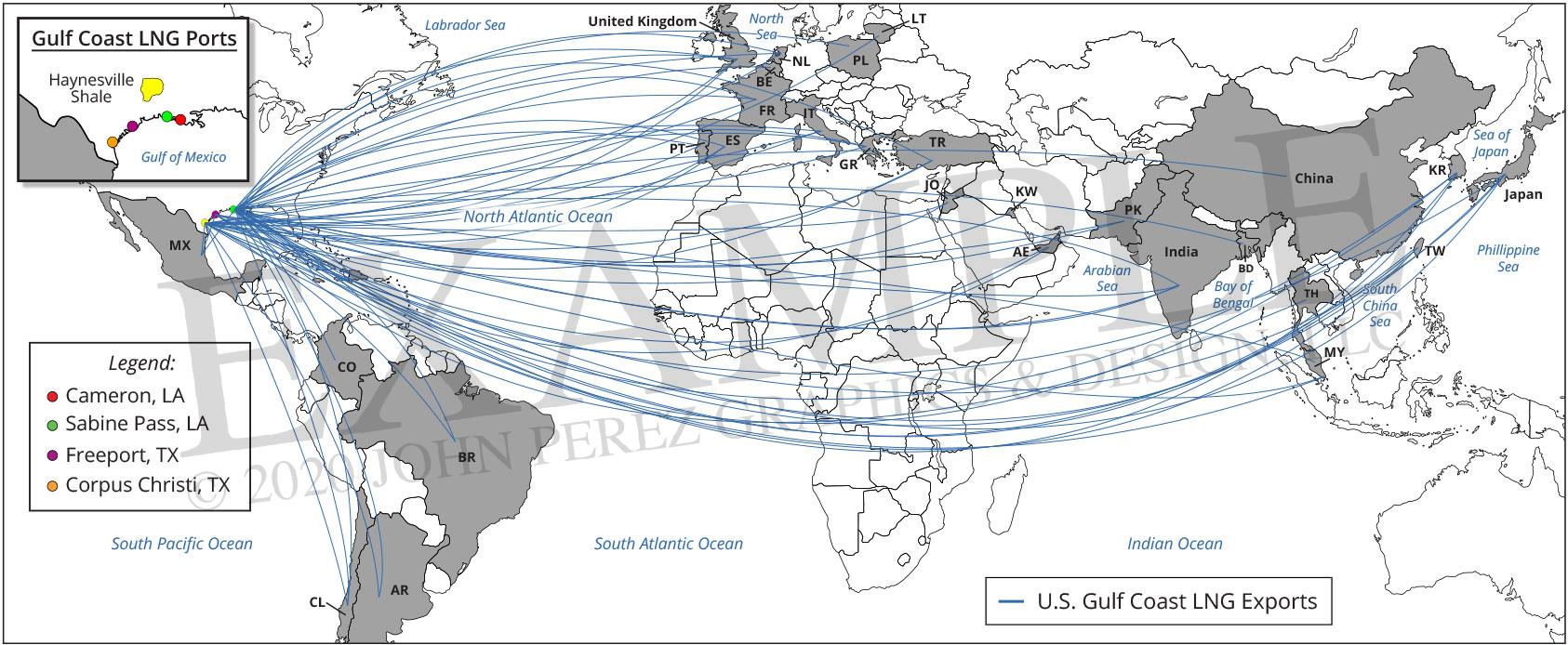

- The Haynesville’s close proximity to existing infrastructure including an extensive pipeline system, processing plants and Gulf Coast LNG export terminals makes the play an attractive operating environment with efficient cycle times from drilling to sales. It is one of the most revenue-generating shale plays in the U.S.

Louisiana Parishes in the Haynesville Shale

Bienville • Bossier • Caddo • Claiborne • Desoto • Jackson • Lincoln

Natchitoches • Ouachita • Red River • Sabine • Webster

Texas Counties in the Haynesville Shale

Angelina • Cherokee • Gregg • Harrison • Marion • Nacogdoches • Panola

Rusk • Sabine • San Augustine • Shelby • Smith • Upshur • Wood

Haynesville Production

In 2017 the USGS announced it had produced an updated calculation that shattered any other prior estimates of recoverable gas in the Haynesville. The Survey’s new estimate was 304 Tcf of recoverable natural gas for the combined Haynesville and Bossier formations that fattened up its prior estimate by a whopping factor of five.

“Changes in technology and industry practices, combined with an increased understanding of the regional geologic framework, can have a significant effect on what resources become technically recoverable,” Walter Guidroz, program coordinator of the USGS Energy Resources Program, said about his scientists’ new assessment of the Haynesville Shale. BP calls the Haynesville Shale “the most revenue generative gas play in the U.S.”

Haynesville Bossier Example Illustrations

Haynesville Bossier Play Locator Map

Haynesville Shale Locator Map Uses: – Map available for license

• Private Placement Memorandum • Oil & Gas Websites • Landowners selling mineral rights • Companies buying mineral rights • Selling oil & gas royalties • Buying oil & gas royalties • Selling overriding royalty interests • Buying overriding royalty interests • Mineral buyers • Selling leases • Buying leases • Lease property in North Louisiana • Lease property in East Texas • Track drilling and production activity • Sale of Mineral Rights • Private Placement Memorandums

We have STOCK OILFIELD ANIMATIONS for:

Oil Rig Drawing • Well Logging • Blowout Preventor • Salt Water Disposal

Haynesville Bossier Play Cutaway Diagram

Drilling – Geology – Illustration available for license

The Haynesville Shale (also known as the Haynesville/Bossier) is a black organic-rich shale formation with an average thickness of 250 feet. Encased by the Cotton Valley Group (sandstone) above and the Smackover Formation (limestone) below, true vertical depths range between 10,000 to 14,000 feet. Long known to contain natural gas, the Haynesville was originally considered to be a source rock and not a gas bearing reservoir because of its tight-rock system and lower permeability. Driven by newer technology, operators have extended lateral lengths from 4,500 feet to 7,500 feet with higher proppant intensities per foot.

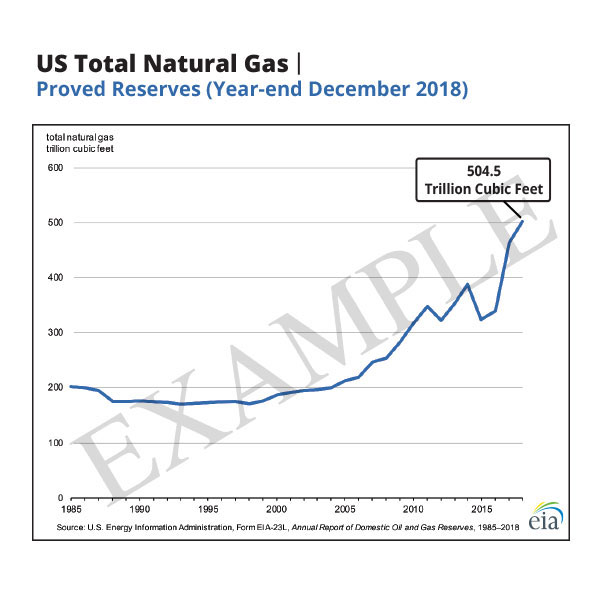

Natural Gas

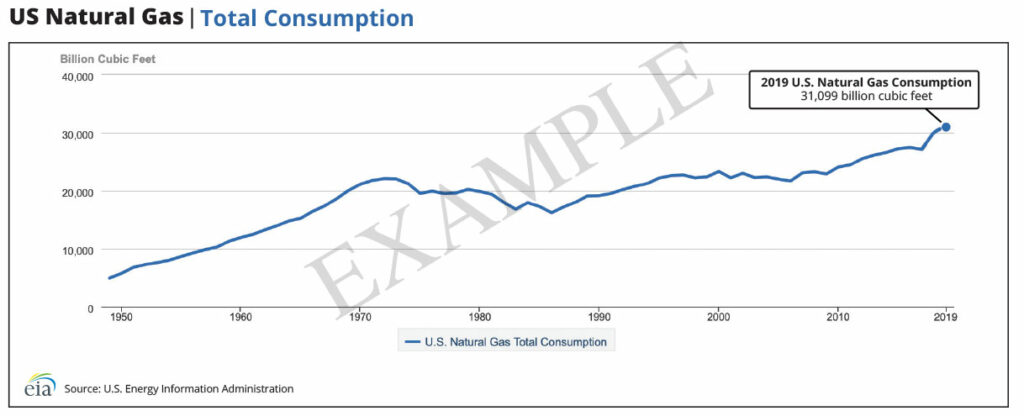

Natural gas is an abundant resource across the United States. As one of the safest and cleanest fuels available, it has become the “fuel of choice” for American homes and industries. According to the FNGA, over 97 percent of the natural gas used domestically is produced here, in North America. In fact, in 2019, US consumption set a new, record high of 31 Trillion cubic feet of gas.

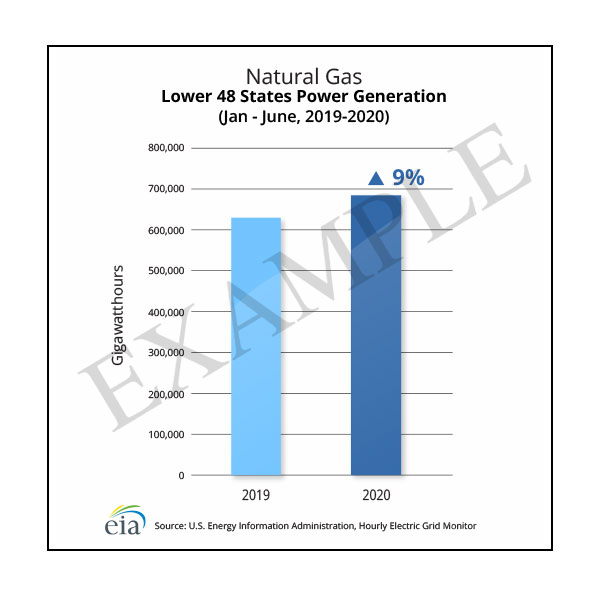

Natural gas is utilized by all sectors: residential, industrial, commercial, transportation and electric power. Despite the pandemic, US power generation from natural gas increased 9% in January to June 2020 over the same period for 2019. Natural gas is also reliable and flexible, used in many industrial processes that produce a wide range of materials and goods such as glass, steel, plastics, pharmaceuticals, food products and clothing.

This STOCK U.S. LNG Export Map is Available for License

(Click here to inquire)

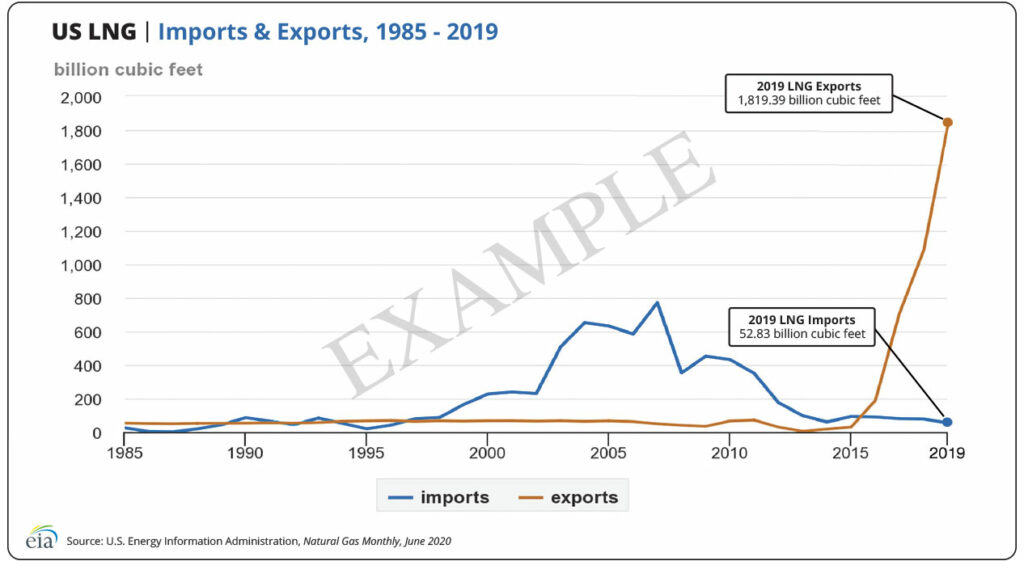

LNG – Liquefied Natural Gas

Liquefied natural gas (LNG) is cooled to approximately minus 260 degrees Fahrenheit to achieve a liquid state for ease of shipping and storage. This process reduces the volume of the liquid to 600 times smaller than the gaseous form making it possible to move natural gas where no pipelines exist and to use it as a fuel for transportation.

The map above illustrates the many countries worldwide that receive exports from LNG carriers transporting from four of the US Gulf Coast area LNG terminals. Some of the world’s largest petrochemical complexes and LNG export facilities are located on the Texas and Louisiana gulf coast near the Haynesville Shale play.

According to World Oil “Global LNG trade will rise 21% by 2025 from 2019, reaching 585 billion cubic meters. The U.S. will become the biggest seller of the super-chilled fuel in 2025.”

As reported by oilprice.com

Dec 18, 2020, 10:00 AM CST

LNG Prices Soar to Six-Year High

“Spot prices for liquefied natural gas (LNG) delivery in Asia jumped to a six-year high this week as lower-than-normal temperatures in key LNG importers and continued growth in China’s industrial activity boost demand.”

Haynesville Shale Companies

Aethon Energy Operating LLC • Anadarko Petroleum • Berry Petroleum • Beusa Energy • BG Group

Blue Dome Operating LLC • BXP Operating Company • Brix Operating LLC • Cabot Oil & Gas

Camterra Resources • Chesapeake Energy • Cobra Oil & Gas Corporation • Cohort Energy • Comstock Resources

Covey Park Gas LLC • Cubic Energy • Denbury Resources • Devon Energy • El Paso Corp. • EnCana Corp. • Encore Acquisition

Ensight IV Energy Management, LLC • EOG Resources • EXCO Resources • Forest Oil • GEP Haynesville, LLC

GMX Resources • Goodrich Petroleum • Indigo Minerals • JW Operating • Memorial Resource Dev. • Noble Energy • Penn Virginia

Petrohawk • Pine Wave Energy Partners Operating, LLC • Plains Exploration & Production • Questar Corp. • Range Resources

Samson Resources • Shell Western • St. Mary Land & Exploration • SM Energy • Southwestern Energy

Tellurian Operating, LLC • Thunderbird Resources LP • Trinity Operating (USG), LLC • Vine Oil & Gas, LP • XTO Energy

• New Sections Coming: Permian Basin, Eagle Ford Shale, Piceance Basin, Denver/DJ Basin, Fort Worth Basin (Barnett Shale)

• Future: Anadarko/Arkoma Basin, Williston Basin (Bakken Shale), Green River Basin, Uinta Basin (Mancos), Appalachian (Marcellus – Utica)

Comstock Resources, Inc. reported financial and operating results for the quarter and year ended December 31, 2020. Drilling Results – Comstock spent $483.6 million during 2020 for drilling and development activities in 2020. Comstock also spent $7.9 million on leasing activity. $476.9 million was spent to develop its Haynesville and Bossier shale properties, comprised of $436.1 million on drilling and completing wells and an additional $40.8 million on other development activity. Comstock drilled 55 (46.1 net) operated horizontal Haynesville shale wells during the year ended December 31, 2020, which had an average lateral length of 9,247 feet.

Comstock also participated in 16 (1.3 net) non-operated Haynesville shale wells in 2020. During the year ended December 31, 2020, Comstock turned 76 (43.7 net) Haynesville shale wells to sales and currently expects to turn 14 (13.0 net) operated wells to sales in the first quarter of 2021.

Since its last operational update, Comstock completed an additional 20 (17.7 net) Haynesville shale wells. The average initial production rate of these wells was 24 MMcf per day and had an average completed lateral length of 9,288 feet.

Information Source:

ShaleTech: Haynesville-Bossier Shales – Controlled by Jerry Jones, the flamboyant owner of the National Football League (NFL) Dallas Cowboys, Comstock became a premier Haynesville operator with the $2.2-billion acquisition of pure play firm Covey Park Energy LLC in July 2019. Comstock now holds a 309,000-net-acre position in the northern Louisiana fairway.

Comstock’s completed well costs are averaging less than $1,000/lateral ft but will likely increase as better prices justify longer laterals and greater completion intensity. Beginning in September, the company reverted from proppant loadings of 2,800 lb/ft to its previous 3,500-to-3,600 lb/ft stimulation strategy. “While it made sense to bring well costs down as low as we did, with weak gas prices this year, with prices closer to $3-plus now, it makes sense to invest in a little more profit, as we believe the wells will have a higher return,” Allison said.

Owing largely to prices, offset frac activity, and widespread inland power outages resulting from Hurricane Laura in late August, Comstock shut-in 7% of third-quarter production.

Like Comstock, Goodrich Petroleum Corp. is exploiting higher prices to elevate proppant concentrations to as high as 4,100 lb/ft, with comparative analysis showing marked increases in recoveries, exceeding the company’s 2.5 Bcf/1,000 ft curves. “Like the short (4,600-ft) laterals, our more recent operated 7,500-ft wells are outperforming materially to a composite estimate of approximately 2.8 Bcf/1,000 ft, due to higher proppant concentration and tighter cluster and frac interval spacing,” President Rob Turnham said on Nov.8.

Following a late third-quarter ramp-up in completions on its comparably modest 24,000-net-acre leasehold, Goodrich expects production to exceed 150,000 Mcfed, entering the fourth quarter, compared to 125,000 Mcfed in the third quarter.

Indigo Natural Resources LLC is among the most active of the privately held operators, averaging four to six rigs and one to two frac spreads. For the year, the company plans to turn 52 wells in line, followed by 10 new producers in the first quarter of 2021, says Sr. VP of Finance and Investor Relations Emily Newport. Indigo will operate five to six rigs and no less than one dedicated frac crew next year on the 435,000 net acres under control.

Fellow private operator Vine Oil & Gas LP. is operating three rigs and one companion frac spread, but is still formulating the 2021 program, which will be presented to stakeholders in February, says Investor Relations Director David Erdman.

Vine controls 188,000 net acres in northwestern Louisiana, where along with the Haynesville, the once-bypassed mid-Bossier zone has emerged as a primary target. Some 500 ft shallower and with associated lower temperatures, Vine’s mid-Bossier wells are trending drainages as high as 2.5 Bcf/1,000 ft, and at completed well costs of $2.75 million for 7,500-ft laterals, they deliver from 50% to 60% return rates.

Meanwhile, for self-described contrarian Kimbell Royalty Partners LP, it’s “I told you so” time, as a once-derided $445-million investment harvests the dividends of a projected 50% increase in gas prices over the next year. With the 2018 acquisition of Haymaker Minerals & Royalties, LLC, the mineral and royalty company now holds non-operating interests in roughly 786,400 gross (7,700 net) Haynesville acres.

“We were aggressive on gas and everybody hated it, “ CEO Robert Ravnaas said. “We are very excited to see the forecasted improvement in natural gas prices, both in the fourth quarter of 2020 and full-year 2021, based on the futures curve.”

Ravnaas said others are taking notice of the improving market. “We have seen a pickup in competition on the gas side that didn’t exist, even six to 12 months ago, but that doesn’t concern us or impede our ability to successfully execute our M&A strategy,” he said. “We like to be contrarian. So, we’re not going to overpay for gas assets in this environment. We’re going to look at them, but we’re not going to overpay.

Information Source:

https://www.worldoil.com/magazine/2020/december-2020/features/shaletech-haynesville-bossier-shales

Source: U.S. Energy Information Administration (EIA)

Haynesville Shale Update

NATURAL GAS – 06 Jan 2021 | 22:34 UTC – New York

Amid bullish outlook, Haynesville gas producers gear up for record output in 2021

HIGHLIGHTS

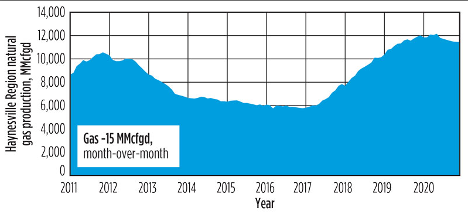

Production averaging over 13 Bcf/d in January

Rig count hits 12-month high at 46 on Dec. 30

Tighter supply, record exports bullish for Haynesville

New York — Haynesville gas production is surging into the new year, climbing to its highest in nearly eight months, as operators there respond to a bullish outlook for the basin’s strategically located supply. In January, Haynesville production gas averaged over 13 Bcf/d as a wave of new rig additions lifts the basin’s total to its highest since January 2020, data compiled by S&P Global Platts Analytics shows.

In the fourth quarter, operators in the Texas-Louisiana shale play added 10 rigs, bringing the total fleet to 46 as of Dec. 30, according to data published by Enverus. Following the fallout in commodity prices last March, the Haynesville is now the only major US shale basin to have fully recovered its drilling fleet.

As output from the Haynesville surges toward prior record highs at over 13.5 Bcf/d – now expected by mid-year according to Platts Analytics – gas production from associated plays like the Permian, the Eagle Ford and the Bakken has continued to stagnate compared to year-ago levels, leaving the Haynesville well positioned to supply a tighter US market.

US supply slump

In January, total US gas production has averaged just 90.7 Bcf/d – down more than 5 Bcf/d from its prior record high and about 3 Bcf/d below its early January 2020 level.

Reduced gas supply from oil-heavy basins has fueled a rally in the Henry Hub 2021 forward gas curve. In late October, the run-up in prices peaked as the calendar-year average topped $3.15/MMBtu.

While mild winter weather and elevated storage volumes have since dampened the outlook for prices, a modest recovery in the forward curve has taken hold since late December as forwards traders reconsider the steep and sustained selloff. On Jan. 5, the calendar-year 2021 Henry Hub price settled at an average $2.80/MMBtu – up about 13%, or more than 30 cents, from its recent low.

For Haynesville producers, current prices offer a generous margin to sustain future growth. According to Platts Analytics, the breakeven wellhead gas price for an average producer has improved significantly in recent years and is now estimated at around $2.50/MMBtu.

Demand

As lower US production continues to put domestic supply under pressure, record LNG feedgas demand at terminals along the Gulf Coast has compounded the tighter market balance, making the Haynesville’s Texas-Louisiana location strategically well placed to benefit

In January, total US feedgas demand has remained at a record-high 11 Bcf/d as US exporters look to capture multiyear highs in Northeast Asia’s import market where the JKM settled Jan. 6 at nearly $20/MMBtu amid a regional cold snap and a surge in Japanese power prices.

With March-delivered cargoes priced at over $10 and April around $7, US exports could be expected to continue at or near full throttle through the first quarter. According to a forecast from Platts Analytics, export demand should remain near 11 Bcf/d through March before retreating below 10 Bcf/d from April to October as global demand wanes in the spring and summer.

According to Platts Analytics, the ongoing midstream buildout from the Haynesville is helping to debottleneck producer access to the Gulf Coast export market, making it strategically placed to supply exporters. In addition to previously completed expansion projects, which have recently added some 1.75 Bcf/d of capacity, a third project under development by Midcoast Energy – the CJ Express – promises to expand market access from the Haynesville by another 1 Bcf/d by later this quarter.

Source: S&P Global Platts Analytics

Watch our 3D Oil and Gas Animation Demo Reel

Please take a look at our latest technical animation work! You’ll see that our creative team is continuing to push beyond their comfort zone to create that “WOW” experience for every client’s play, tool or oil and gas technology project with our animated graphics. Need to explain enhanced oil recovery, stacked pay or oil investments in unconventional oil? No problem. Our seasoned technical animator team specialize in process, mechanical and industrial animations as seen in our animation demo reel.

With new effects and cutting-edge, 3D modeling software, we can go beyond the norm and create that one of a kind technical animation, illustration, or oil and gas graphic animation you’re looking for! These 3D oil and gas graphics are from many projects we have created up to this point. Look, experience and…